Historic Homes Renovation Financing Options and Eligibility Challenges

Historic home renovation grants are generally available to public properties and nonprofits. A private historic homeowner can find grants from the state, federal, or local levels including philanthropic groups. You can look for grants associated with your locality at the National Trust for Historic Preservation Bureau or visit PreservationDirectory.com or at State Historic Preservation Office.

Grant and loan options for historic homes

The eligibility of grants differs a lot. It includes when, where, and how to use the grant funds. Besides grant historic home buyers can look for other financing sources. The most popular one is the FHA 203k Rehab Loan program supported by the federal government. It bundles your renovation expenses and primary mortgage into a single loan.

The down payment goes as low as 3.5%, while the interest rate is adjustable or fixed. However, the terms of eligibility are you need a good credit score i.e., close to 620. Another constrain to FHA 203k is the buyer will need to pay loan insurance just like mortgages with a 20% down payment.

Another option is Title 1 loan supported by HUD. It allows borrowing an unsecured amount of $7,500 to a maximum of $25,000. Buyers capable to pay 20% down payment prefer Freddie Mac’s CHOICERenovation or Fannie Mae’s Homestyle renovation loan, which is similar to the 203k program. You gain a loan bundle but there is a need for PMI [private mortgage insurance] until your equity attains 20% of home value, which can be avoided if you pay a 20% down payment.

Linden Estate

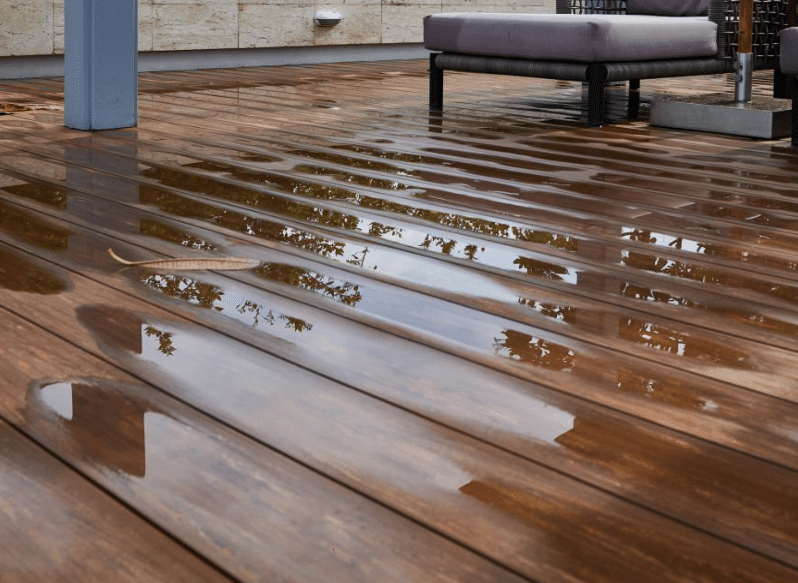

If you are interested in a European-style Manor house then check the Linden Estate spanning across 18,000 sq. feet then it is in the market. It is located in the most coveted East Section in Southampton. It is a legacy building standing proudly on a 10-acre land surrounded by ornamental Linden trees. Current, owners gave this historic mansion a careful lift and its selling price is $75 million. Check the Hamptons guide to see if the home is eligible for loans or grants.

The three stories home is seeped with a remarkable history and is perfect for families and entertaining. The space has 9 bedrooms, separate staff quarters, 12 full & 3 half baths, master suite, gym, steam room, library, and fireplaces. Other resort-style amenities include a box pool house, outdoor pool, a spa, tennis court, carriage house, greenhouse, equipment house, two pavilions, two garages, as well as an indoor pool with slide and waterfall.

Other historic home renovation options

- Home equity loan option – Your primary residence can be considered as an option to obtain a loan for the secondary historic home investment. The borrowed funds can be used to pay for a renovation.

- Personal loan – Explore the unsecured personal loan option as you will not need to use the primary home as collateral. If you have a great credit score then the chance to gain an unsecured personal loan at a low rate is possible.

- Tax credits – Historic Rehab Tax Credit of 20% is offered to historic homes that produce income [rental or home office]. For the 10% rehab credit credibility, the property has to be constructed before 1936. Consult tax professionals for advice and options.

Historic homes are more than 50 decades old so can need plenty of work, especially if they were not well-preserved. Therefore, have a trusted surveyor for perfect home inspection and evaluation before purchasing.